Software · Quant Finance · Deep Learning

The financial area is saturated with educational approaches that are not supported by consistent results. Academic evidence accumulated over decades on the Efficient Market Hypothesis demonstrates that beating benchmarks in a sustained manner is statistically difficult.

Technical analysis, in isolation, does not constitute a universal solution. After extensive historical testing and empirical validation, it is observed that purely mechanical strategies rarely present risk-adjusted returns superior to the market in the long run. Many publicly promoted results do not reflect the statistical robustness required by scientific literature.

My approach is based on a hybrid model, inspired by institutional practices and adapted for retail execution. It integrates technical, fundamental, and macroeconomic analysis, with a clear focus on risk management, capital preservation, and consistency over time.

About

Software engineer with over 15 years of experience building applications at the intersection of technology, finance and artificial intelligence.

Background

I founded Quantum Flow Investments, where I lead the development of fully automated trading systems based on machine learning. Previously, I created Financial Flow, a real-time financial news app that I presented at Web Summit Lisbon.

Expertise

CNNs, RNNs, LSTMs, Transformers, Reinforcement Learning

Backtesting, time series analysis, risk management and portfolio optimization

C++, C#, Node.js, Rust, Python, SQL. Scalable data pipelines

Beyond code

I contribute to open-source projects: from voice assistants with ChatGPT, computer vision tools for license plate recognition, to cryptocurrency performance trackers and momentum strategies for the S&P500.

Journey

Wrote my first lines of code

Created my first MMO online game

Freelance: online stores, landing pages, web development

Participated in the development of The Pirate: Caribbean Hunt

Completed several cybersecurity certifications and performed Bug Bounty work

Entered the world of trading

Focused on US indices and stocks trading. Developed SARS-CoV2-Predictor to predict daily COVID-19 cases

Dove deep into Machine Learning and Computer Vision

Started living exclusively from discretionary trading

Published a book on Technical Analysis and Trading

Developed trading algorithms and large-scale backtesting. Experimented with prop firm platforms and received my first payout in August

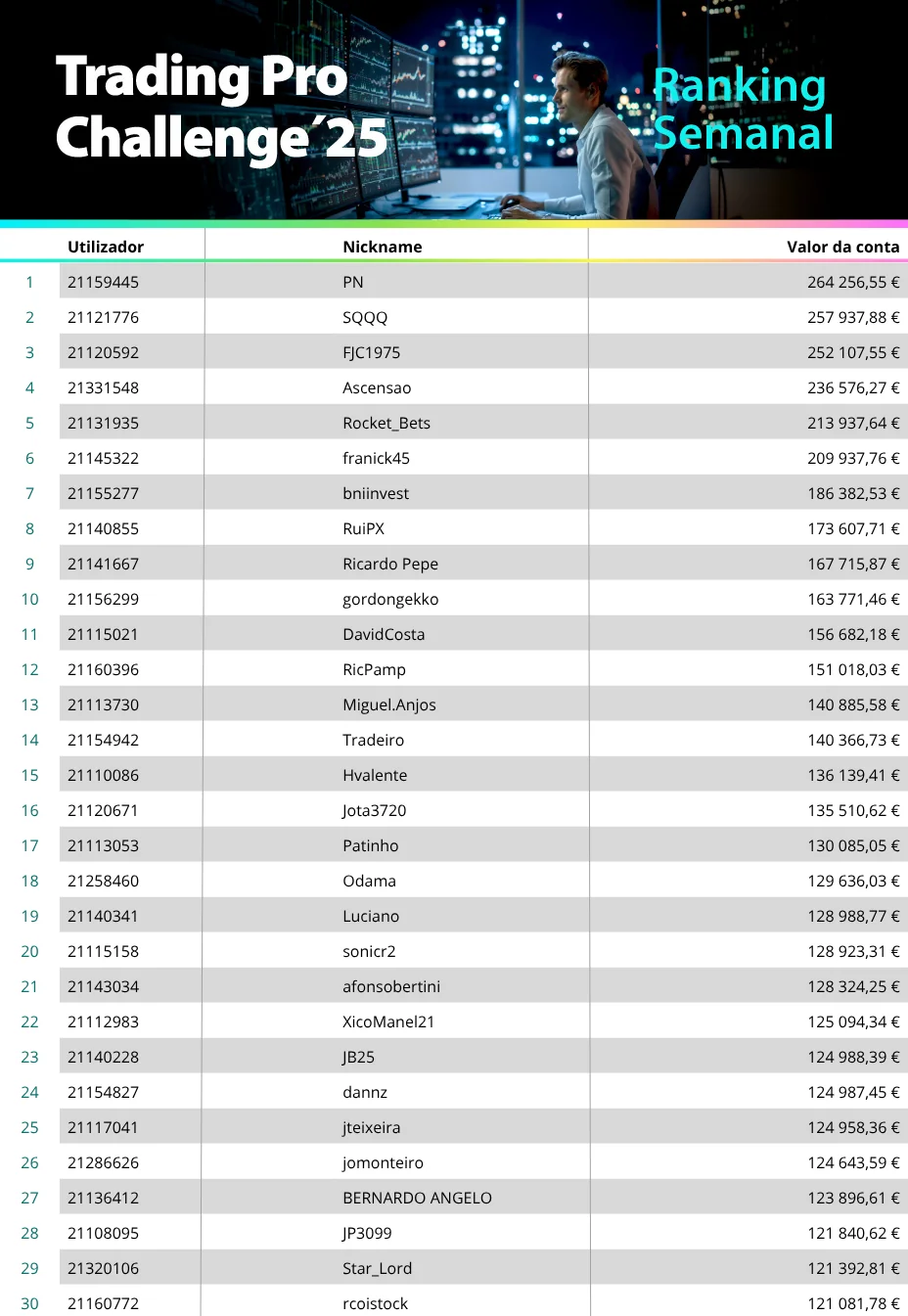

Founded Quantum Flow Investments. In October, at the Novo Banco Trading Challenge, reached 4th place with +136%

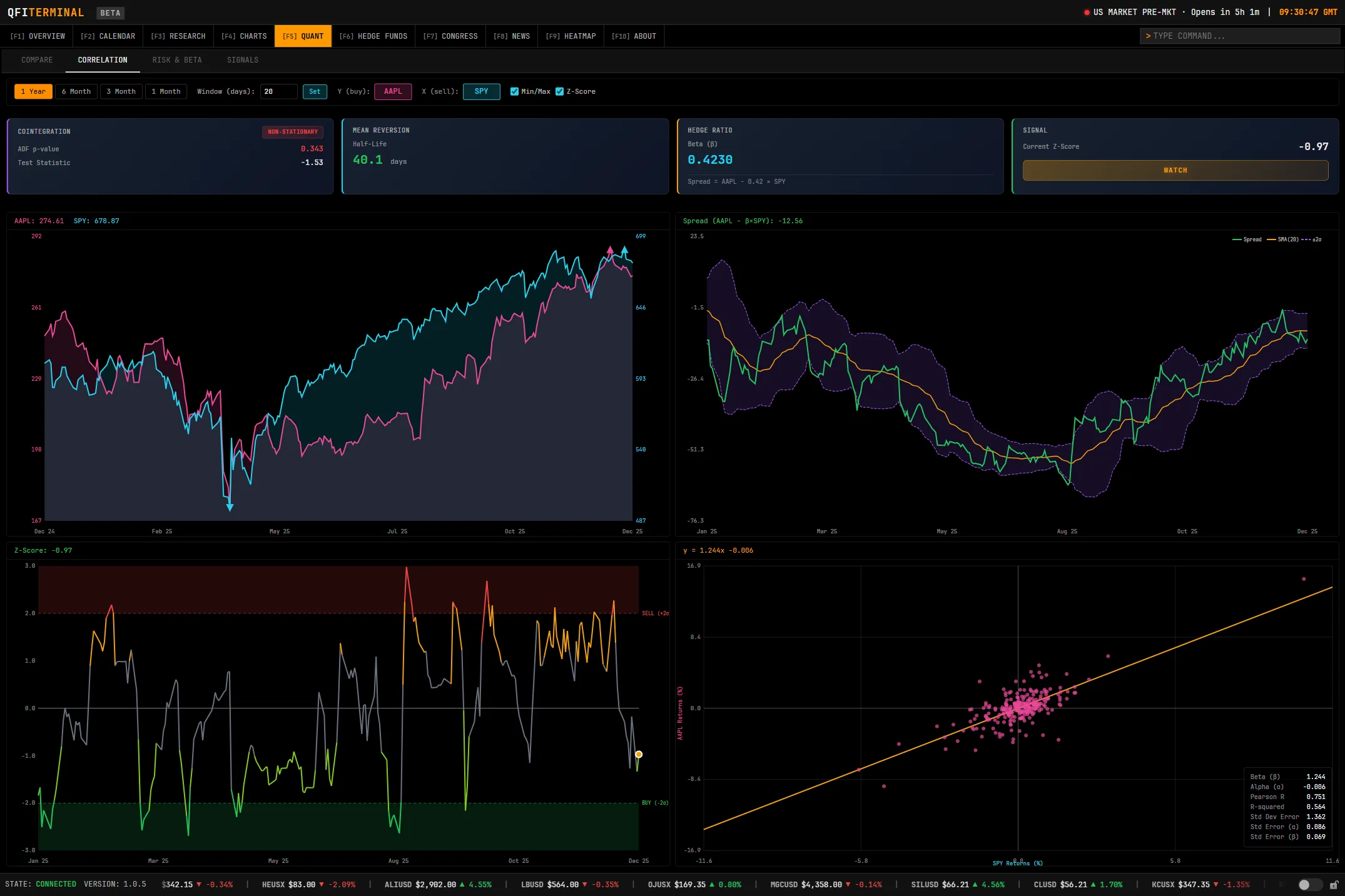

QFI Terminal

Institutional-grade financial terminal with 10 specialized modules: quantitative analysis, correlation matrices, fundamental research, monitoring of 100+ hedge funds, insider tracking and much more. Coverage of 8,000+ securities and 50+ data sources.

Gallery

If you've made it this far, you're probably expecting

The moment I ask for your email.

The €997 course with "limited spots".

The VIP signals group.

The exclusive mentorship at €199/month.

Sorry to disappoint you.

I don't sell courses. I don't sell signals. I don't have paid groups.

But I can give you something I've been building recently:

The QFI Terminal.

A tool that rivals Yahoo Finance, Google Finance, Finviz and Investing.com and many others

No registration. No subscription. No tricks.

Completely free.